by Jack Coursen of the American Speech-Language-Hearing Association (ASHA)

Subscriptions are everywhere. While the cumulative costs of them makes me second-guess whether the trend in entertainment is a clear winner for consumers, there is one type of subscription I have no reservations about: learning subscriptions. Learning and subscription work so well together that, after offering a learning subscription at the American Speech-Language-Hearing Association (ASHA) for more than two years, the old pay-per-course model looks downright hostile to learning.

Continuing education (CE) subscriptions have been around for a long time, but, when we considered that option a decade ago at ASHA, we said, “It’s not for us.” Back then, most of the learning subscriptions in our space were content factories churning out live Webinars. That idea was easy to dismiss under the pretense that we are more thoughtful in our approach to learning design.

I was wrong. Not every learning subscription needs to be a content factory. In fact, thoughtful learning design is better in a learning subscription model. So is non-dues revenue. Two discoveries helped us figure that out.

In the summer of 2016, our team conducted a pricing sensitivity study, ostensibly to figure out whether we really did charge “too much,” as feared. Following those results, we analyzed how many customers returned from one year to the next (i.e., customer retention).

<<< Aside >>> The goal of the pricing study was to explore a pervasive and internalized sense that our courses “cost too much.” After years of members’ expressing that sentiment, we were more than a little neurotic about our prices! The study results showed that every single one of our prices fell in a tolerable pricing range. In fact, the only product with a substantial gap between perceived value and price was far underpriced.

What we had was not a pricing problem; it was a perception problem stemming from a small, but vocal group of members. That realization was huge (!) and prompted us to consider related questions. Even if our per-course price is okay (neurosis are hard to let go of), what would a customer have to pay us to get all the credits they need in a year or over a two- to three-year licensure or certification interval? Was that cumulative cost too high?

While our pricing was fine, among the study results, we found that customers reported spending far more on CE every year than they spent with us, especially so in the case of our past customers. Why? The survey results of our learning offerings consistently yielded staggeringly high overall satisfaction ratings. Learners loved and trusted our content. What was it?

To explore that question, we looked at customer purchasing patterns. We knew that our total number of paying customers was steadily, albeit slowly, increasing from one year to the next. Were we slowly acquiring new customers while most of our existing customers came back year after year? The results were alarming.

<<< Aside >>> What about you? Do you reach more customers with your learning offerings every year? How many of your customers buy year after year? Do you know? If not, take a guess. Or, better yet, find out!

We tripled-checked the results of our analysis: 80 percent! Yes, 80 percent dropped off from one year to the next. The thing about tearing a Band-Aid off is that, sure, it hurts. It might hurt a little more if you don’t even realize you are tearing it off. On the other hand, once it’s off, you can see what’s under it.

It wasn’t just a fluke. We could pick any two back-to-back years, and it was pretty much the same. The vast majority of our customers didn’t return the following year. Looking for ways to soften the blow, further analysis showed that over a three-plus-year period, customers were returning. The real silver lining we found was if, despite the drop-off, we were growing year over year, we were unexpectedly great at acquiring new customers, which, comparatively speaking, is a lot more difficult than retaining existing customers. So how could we improve our customer retention? Maybe Netflix has a documentary on that?

A Different Model, Down to Its Core

Selling individual products is a one-time transaction. You pitch the product, pull the customer into the funnel, process the payment, recognize all the revenue immediately, deliver the product, and that’s that. To get that person to buy again, however, you have to go through that entire process again.

Subscriptions, by design, intend to keep people in. You pitch the subscription, which is a different sort of product and has a different value proposition. You are committing to solve the customer’s problem continuously, and, assuming you deliver and it’s easy, they’ll continue to stay.

<<< Aside >>> As you may have guessed by now, automatic recurring billing is critical to making the most of subscription models. Prior to our learning subscription, we didn’t have the functionality to store credit cards (or tokens). We added it.

There are a lot of new things to learn in establishing a learning subscription: what’s included, how long are terms, how do you recognize revenue, regulatory compliance, how and why people do or don’t renew, engaging with existing subscribers and promoting the subscription to prospects in parallel, the potential for organizational sales, and so on.

But it’s doable. If a cupcake company can handle automatic recurring billing for their “sweetscription,” you can too.

Using this new model, you’ll continue to entice new customers, but you’ll also retain existing customers more effectively, and you can quickly realize big gains in overall numbers. That means more learners, learners have access to more learning, and revenue starts adding up.

Revenue Potential

If you could retain more customers through a subscription, what impact would it have on your revenue? That question is worth exploring a bit more, even if it requires a bit of math. Here’s a basic example that you can tailor to fit your learning business.

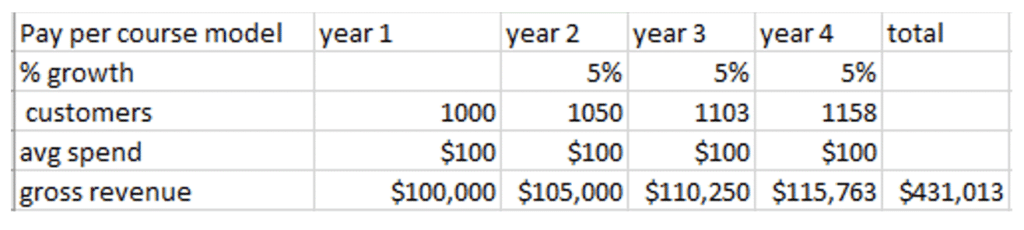

Let’s start with a simplified view of the current pay-per-product approach. Let’s say you have 1,000 customers, they spend $100 each on average, and you grow about 5 percent every year. After four years, you have 1,158 current learners and have generated a total of $431K in revenue.

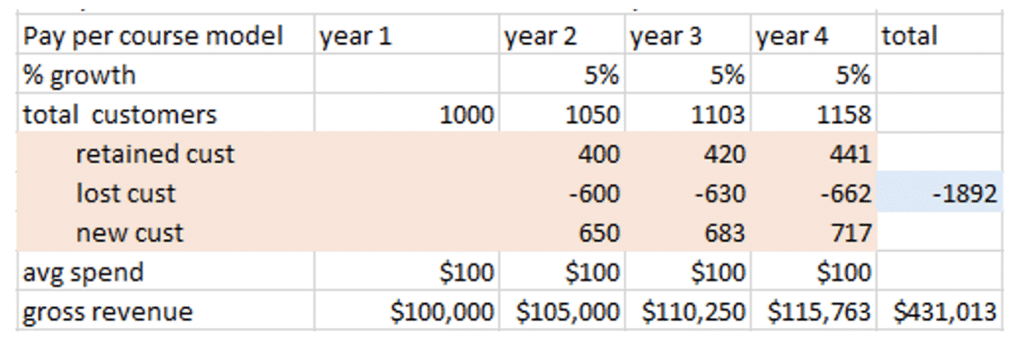

Let’s say that, in exploring your growth rate of 5 percent, you find that only 40 percent of your customers in one year will return the following year, but 60 percent won’t. Now the totals are still the same, but you can differentiate customers by those retained from last year, those lost from last year, and new customers.

Now you can also see how many customers—1,892—you lost over that four-year period.

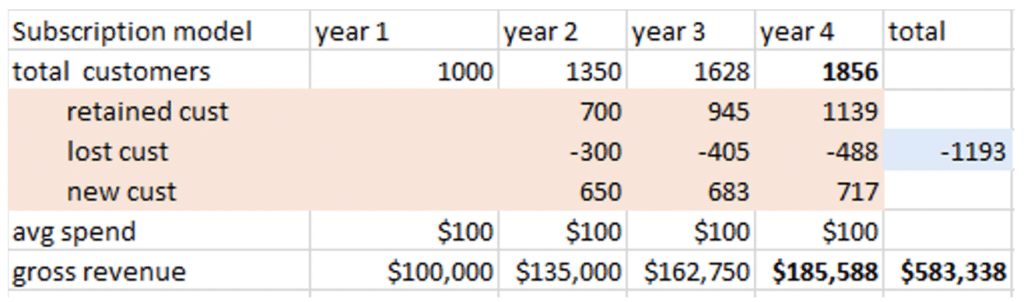

Let’s compare the pay-per-product model to a subscription model that’s designed to retain customers. We’ll assume that new customer acquisition is the same as above, but instead of retaining only 40 percent as the old model did, the subscription model will retain 70 percent of customers from one year to the next because of automatic recurring billing.

<<< Aside >>> Incidentally, these hypothetical numbers might not be so far from your reality. In our case, with nearly two years under our learning subscription belt, the number of customers leaving from one year to the next has been cut in half, from 80 percent to about 40 percent. That’s been a huge positive to our bottom line, but that drop-off is still larger than subscription industry norms, which also means that we’ve got more room to improve.

As the totals for the subscription model show, there are notable gains in total customers and gross revenue. But there is a twist: deferred revenue recognition.

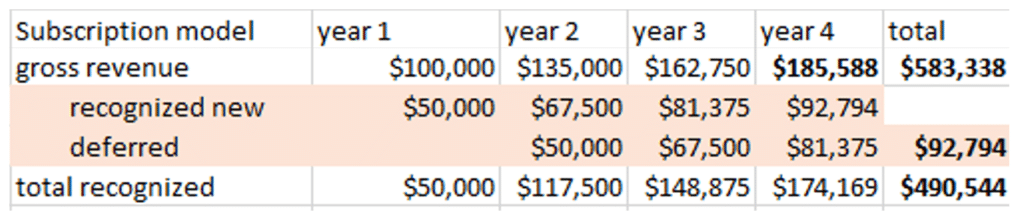

Check with your finance team, but new accounting regulations require us to recognize only the portion of the revenue corresponding with the period of access in each calendar year. Our CE subscription is a year of access from when the member signed up, so, if someone signs up on July 1, we recognize half of the payment this year and defer half to the following year.

Unpacking this issue using the example above, we need to differentiate gross revenue between the new revenue we can recognize this year and revenue that will be deferred to next year.

Two issues are particularly striking. First, year one is tough because recognized revenue is lower than the old model. Second, you’ll start January 1 of every following year knowing you have a sizable amount of revenue already banked to be recognized. You’ll be able to speak to both of these issues when talking to your executive team and financial planning board.

All told, in the subscription model, after four years, you have 60 percent more active learners; you have a huge increase in revenue and start each new year with a sizable amount already banked to be recognized; and you have lost far fewer learners over that period.

It’s not that hard to tweak the numbers and percentages to fit your use case and see how the math works out for you. For any organization where more customers drop off from one year to the next, where your year-over-year growth is less stable (or where growth is more reliant on creating novel products to sell), or where your costs of getting new customers are especially high, a subscription will likely pan out better and faster for you. But subscriptions aren’t just about the revenue. They are about the relationship that you build over time with your learner.

Lifelong Learning

We love to talk about the idea of lifelong learning. It’s so important. Now, more than ever, lifelong learning is critical. For upskilling. For reskilling. But is that just talk? Is our business model facilitating that promise or undercutting it?

Let’s consider the pay-per-product model with an eye toward lifelong learning. Among the many critical takeaways from the science of effective learning is that learning is a process, not a one-time activity.

In a pay-per-product model, are your learners buying multiple complementary educational offerings with you? Ours weren’t, even when we created series of highly complementary content and bundled them together with a steep discount.

Are your learners discovering and exploring new areas that expand their breadth of knowledge? Most of our learners were doing almost the opposite, sticking to just what they needed, both in terms of topics and quantity.

Are you able to retain cohorts across longer periods of time to re-engage them in material or expand on prior instruction? We couldn’t because by the time that follow-up offering came out, learners had to ask themselves whether they wanted to spend their limited time and budget on that appealing follow-up or pick something on another topic that they also were really interested in.

Are your learners consuming lots of educational content? Ours weren’t because it was just too expensive to do so in the old model. Instead, most of our learners focused on getting just what they needed, their required number of hours for the year.

What about strategically important topics, like culturally responsive practice, ethics, or other topics that we know are critical for the future, but that many members don’t recognize as critical yet? Some of our learners do prioritize those sorts of topics, but the vast majority prioritize topics they feel are more urgent in meeting the needs of their clients. What effect did those learner trends in the old model have on us? Since learners weren’t doing that stuff, we often made less of it.

The pay-per-course model is hostile to lifelong learning and to best practices in effective learning.

<<< Aside >>> Telehealth used to be a strategically important “broccoli” topic for us. Before the pandemic, only 7 percent of our members had experience with telehealth, and for good reason—because there were major impediments to adoption. Even so, knowing that it was critical for the future of the professions, we had developed a rich catalog of educational content on the topic.

When the pandemic lockdowns happened, almost overnight, more than 70 percent of our members needed to deliver services via telehealth. We were able to eliminate all barriers to accessing those critical resources by providing our entire membership with free access to all that content through our learning subscription. During the three months of free access, roughly 60,000 members consumed 600,000 hours of education, and courses on telehealth and related service delivery were by far the most popular topics.

Now let’s consider the learning subscription model. Your learner signs up, gets unlimited access to a vast catalog of offerings, and retains that access until they cancel. Will learners take multiple complementary offerings? For us, many more do, and, while there will always be some learners who do and some who don’t, the subscription makes it easy. Will learners re-engage with content or participate in a new experience that builds off a course they did last year? For us, many more do, and, again, either way, it’s easy for them. Plus, we think that type of expanded content encourages learners to continue subscribing.

What effect does that have on us? We’re creating more learning pathways, more complementary content, thinking more about how content expands the current catalog, about multi-year content series development, and so on. We’re thinking about how our other offerings, like in-person and online conferences, could intentionally complement the learning subscription. We have staff focused specifically on strategic curation and engagement, and we’ve expanded our learning business strategy to prioritize strategic influence, i.e., how we can foster more engagement on topics of critical importance.

Our learning subscription model incentivizes us to draw learners in and keep them engaged so they remain subscribers. It requires us to continuously demonstrate value by highlighting new content more evenly throughout the year and curating content in ways that catch learners’ attention. It forces us to change our data analytics, to look at what our learners are doing, not just what they’re buying. It challenges us to listen closely to what they need through regular surveys and then to deliver on those needs.

The learning subscription model complements lifelong learning and encourages best practices in effective learning.

I don’t claim that we’ve figured everything out, but we’ve realized tremendous revenue growth, seen huge increases in learning engagement, and been energized by what seems possible from a learning impact standpoint through the learning subscription model.

About the Author

Jack Coursen is the senior director of professional development at the American Speech-Language-Hearing Association (ASHA). His team manages a portfolio of more than 700 learning activities, which roughly 30,000 members spend 300,000 hours engaging with every year. Their learning business priorities are member impact, non-dues revenue, and strategic influence.

See also:

Focusing on Credentialing Outcomes with J. David M. Rozsa

Focusing on Credentialing Outcomes with J. David M. Rozsa

Leave a Reply