Understanding the value your learning business delivers with its range of offerings is hugely insightful. But objectively evaluating the value of your products can be a challenge.

That’s why we created the Product Value Profile, a free tool that offers a way to assess and visually represent the value you currently deliver with a specific product or product line and the perception of that value in the market.

In this third episode in our informal series on tools for learning businesses, we explain what the Product Value Profile is and why and how to use it. We also discuss how it can be used in conjunction with the Value Ramp to inform decisions about pricing.

To tune in, listen below. To make sure you catch all future episodes, be sure to subscribe via RSS, Apple Podcasts, Spotify, Stitcher Radio, iHeartRadio, PodBean, or any podcatcher service you may use (e.g., Overcast). And, if you like the podcast, be sure to give it a tweet.

Listen to the Show

Access the Transcript

Download a PDF transcript of this episode’s audio.

Read the Show Notes

[00:00] – Intro

Why Use the Product Value Profile?

[01:04] – As we talked about when sharing the Value Ramp, price and value are closely linked. Raise value, and the price can and should go up. But to raise value, you first have to evaluate the perceived value of your products. The Product Value Profile is a way to do just that—it’s a way to evaluate the value of your products objectively.

When you increase the value of a product, you can charge more, and pricing is essential for all learning businesses. Even nonprofit learning businesses need revenue to continue to exist and deliver on their mission.

Price and revenue aside, most learning businesses want to have a good grasp on the value their offerings deliver because that usually relates directly to the impact those offerings have in the market.

See our related episode “One Word: Impact.”

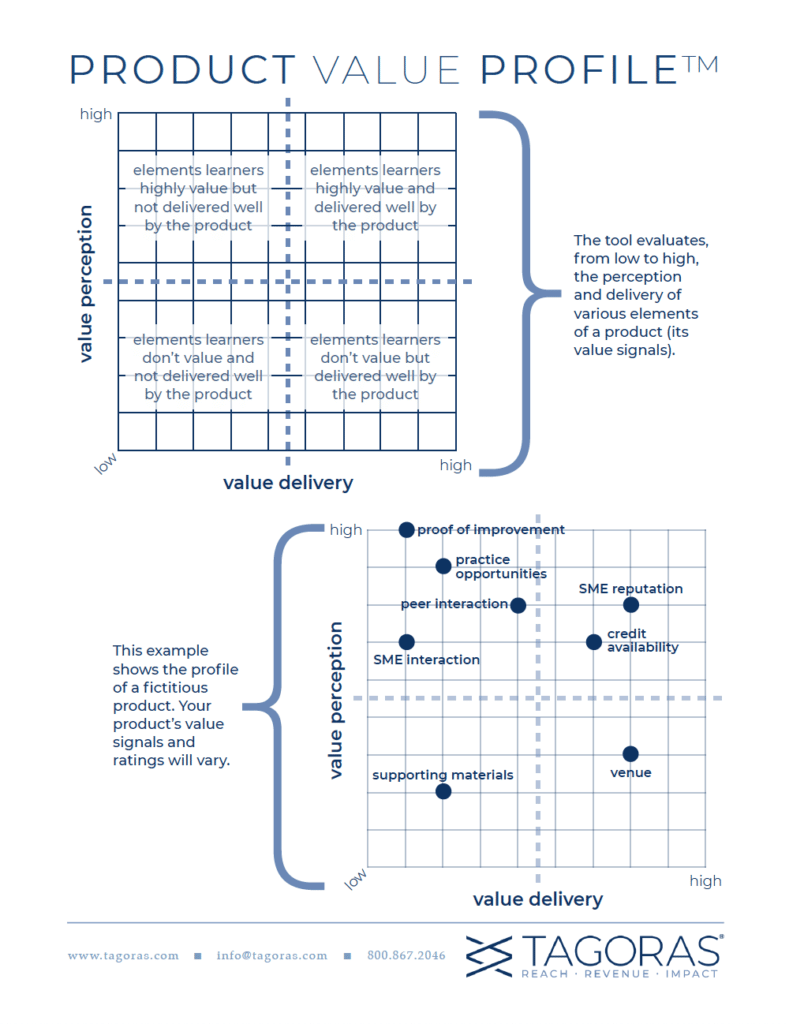

The Product Value Profile is a tool that offers a way to assess and visually represent the value you deliver with a specific product or product line and the perception of that value in the market. By doing this kind of evaluation, you’ll get insight into what value signals you can adjust to change both the value and the price of your specific product or line of products.

The Product Value Profile and the Value Ramp complement each other. Think of the Value Ramp as the bigger-picture tool—it’s a way to help you visualize your entire portfolio and tell an overall value story that makes sense. The Product Value Profile helps you zoom in to better understand particular individual offerings that fall along your Value Ramp.

Both the Value Ramp and the Product Value Profile are descriptive tools—they help you assess and understand your current offerings. But they both also offer opportunities to change and improve.

Once you understand your Value Ramp and the value profiles of your products as they currently exist, then you have a solid basis for making adjustments, for using some levers, for using value signals to influence how your products are perceived and therefore what you can charge for them and where they might come to fit on a future Value Ramp, a Value Ramp that you aspire to make reality.

Celisa Steele

See our related episode “Tool Talk: The Value Ramp.”

Partner with Tagoras

[03:45] – At Tagoras, we’re experts in the global business of lifelong learning, and we use our expertise to help clients better understand their markets, connect with new customers, make the right investment decisions, and grow their learning businesses. We achieve these goals through expert market assessment, strategy formulation, and platform selection services. If you are looking for a partner to help your learning business achieve greater reach, revenue, and impact, learn more at tagoras.com/services.

What Is the Product Value Profile?

[04:16] – Now that we’ve talked about why, let’s turn to what. The Product Value Profile is a tool that offers a way to assess and visually represent the value you deliver with a specific offering. And it involves looking at value signals. You can download a nicely formatted handout on the Product Value Profile for free on the Tagoras Web site. (Tagoras is the parent company of Leading Learning.)

By “value signals” we mean the aspects of your product that you actively communicate to your audience and then provide as part of delivering your offering. You can think of these as features or benefits—the kinds of things that you might emphasize in your marketing materials about the offering.

For learning businesses, value signals might include the following:

- Reputation of the subject matter expert (SME) involved in designing or delivering the learning experience

- Access to SMEs or facilitators

- Access to peers for support or networking

- Practice and application opportunities

- Supporting materials provided

- Credit availability

- Proof of demonstrable improvement

- Related costs (e.g., travel)

- Venue (for place-based offerings)

- Software features (for online offerings)

The above items aren’t an exhaustive list, but hopefully they give an idea of the kinds of value signals that tend to be tied to continuing education, professional development, and lifelong learning.

Not all value signals you identify will apply to all your offerings. For example, venue doesn’t apply to online offerings. That’s obvious, but there are others that may be a little less obvious. You might think learners will always want the opportunity for practice, but if you have an offering that’s focused on conveying information—e.g., an overview of a regulation their industry or field—then the opportunity to practice may not apply. Learners just need to know the regulation; they don’t necessarily need to spend time practicing. In that case, practice is not a value-add.

Another example of a value signal that might vary is length. If learners want or need an in-depth look at a topic, then a longer learning experience could be valued. In other situations, learners might want or need a targeted, tightly focused take on a topic, and the faster they can get that, the better. Microlearning can come into play here, where you home in on a single objective and deliver it quickly.

Now, it takes effort to identify your value signals and then to assess how those value signals are perceived by your audiences and how well you’re doing on delivering on those value signals. But it’s effort that’s definitely worth it if you’re looking at how to improve performance or maximize sales for a specific product or product line.

Celisa Steele

Key Sources of Input for the Product Value Profile

[09:14] – You need input from key sources:

- Get input from internal experts (staff and volunteers). What do they think your key value signals are?

- Get perspective from a sampling of ideal learners and customers (i.e., people you want to reach with the offering). What are they looking for in terms of the value in a learning experience?

- Look at what your most successful competitors are doing. On what value signals do they seem to place the most emphasis?

Get input from each of these groups on what they perceive as the most valuable aspects of the offering and how well you deliver this value.

You should also inform these inputs with the ongoing input that you’re getting from something like the Market Insight Matrix so that you really have a sense of what’s valued out in the marketplace around particular types of learning experiences.

See our related episode “Tool Talk: The Market Insight Matrix.”

This input you’ll gather will give you your value signals, and those value signals become points that you plot on the Product Value Profile.

The vertical axis is value perception, with the perception of value being low at the bottom and going up. The horizontal axis is value delivery, low-value delivery at the left and increasing as you move to the right.

By “value perception” we mean what do your learners value, what’s important to them? By “value delivery” we mean how well are you delivering on what your learners value?

For the two axes, you might use a 1-to-10 scale. For value perception, 1 would be something learners don’t find valuable; if it went away, they wouldn’t miss it. 10 is what learners value most. On the value delivery side, 1 means you’re failing to deliver on that value signal, and you have lots of room to improve. A 10 means you’re hitting it out of the park.

The Product Value Profile double-axis chart has four quadrants. The lower left quadrant is where value delivery and value perception are low—so that’s a quadrant you don’t need to give much attention to.

The upper right quadrant is where value is perceived as high, and you are effectively delivering on that value. That’s a good place to be, and you should give your team kudos.

But the upper left and bottom right quadrants are where you may have some room to adjust. Those are where you’re going to really want to give some time and attention. In the upper left, value perception is high. These are things your customers consider important, but you are not delivering on them well. The bottom right is where you’re delivering well but these aren’t elements that your customers value highly—so these are aspects where you might be investing more than you should.

How to Use the Product Value Profile?

[13:49] – Once you know the value signals for a particular offering, which you arrive at by asking and observing key stakeholders, you plot those value signals as points on your double-axis chart. Each point will have an x and a y coordinate.

Let’s take the example of “practice opportunities” as a value signal, and let’s say that you determine your learners seek out practice opportunities (i.e., they consider practice valuable). So you rate that an 8 on the 10-point scale for value perception.

But the e-learning course you’re evaluating has just two simple self-check quizzes, so you give the product a 3 for value delivery. That puts the “practice opportunities” in the upper left quadrant. A very high-value offering will have most of the signals plotted in the upper right quadrant, where both perception and delivery are high.

There’s probably as much art as science in determining how to evaluate each value signal and where it falls on a scale between 1 and 10. It’s important to look for any hard evidence that you can when assessing.

You want to talk about the ratings as a group, but have people think about the ratings beforehand and bring whatever evidence they have around a particular value signal to the discussion. Asking individuals to think about ratings before meeting together minimizes the chances of groupthink.

If you want to get more scientific about these ratings, you could do a conjoint analysis. This involves collecting data from a large number of your target end users to identify which elements they value. You run statistical analyses to come out with what they value the most.

In some ways, what this Product Value Profile is giving you is, basically, a budget version of doing a conjoint analysis, which can be quite complex and quite costly.

Jeff Cobb

[16:28] – The result is a visualization of how your various value signals rate in terms of how they are perceived and how well you are delivering on them. Just having those points plotted can give you ideas for what to adjust. Anything that’s low on value perception—that is, your customers don’t believe those aspects are valuable—can be examined and potential cut or scaled back, especially if they’re expensive. You might be able to double-down on elements that are highly valued. And for the elements that are valued and that you’re delivering well on, those are things to tout and emphasize in your promotion.

Another valuable exercise is to create Product Value Profiles for each of your key competitors and overlay those on your profile. How do you compare? How different do you look? What could you shift to make your products stand out more in the market?

This might mean investing more in areas where you are already strong in delivering value. It may also mean deciding to ignore or de-emphasize other areas because you don’t feel the resource commitment is worth it, and you decide to concede that to a competitor because you’re differentiating on other factors.

You could also think about new value signals. If you can legitimately come up with other value signals, things that are perceived as valuable by your market and that you can deliver on, then do those things. Those can become your differentiators and help stand you out from the other offerings learners could choose instead of what you offer.

The goal is not to shift everything into the upper right (high-value delivery and high-value perception). It’s usually impractical and often cost-prohibitive to try to shift everything to the upper right quadrant.

The goal is to identify very high-value items that you do (or can) deliver on better than the competition and focus on getting those as high as possible in the upper right quadrant. Ultimately, you want a value profile that is as attractive as possible while clearly standing out from the profiles of your key competitors.

Given the effort involved, you probably won’t create a Product Value Profile for each product you offer, particularly if your portfolio is large. Instead, you might focus on a line of similar products or on a product that’s underperforming. If you’re not hitting the revenue goals or the enrollment goals that you have for that offering, then this exercise can help you understand what you might adjust to create a more valuable product.

On the flip side, if you have a product that’s beating projections and outperforming other similar offerings in your portfolio, you might use the Product Value Profile to better understand the value of that product. Once you do, you may be able to apply what you learn to improve those other products that aren’t performing as well.

Product Value Profile and Pricing

[20:23] – Here some ways the Product Value Profile can be used with respect to pricing.

First, if you are not achieving the sales you had expected with a particular offering, you can take steps to adjust the value signals so that value will be perceived as more in line with the price you’re charging. To do that, you would take steps to improve your delivery of some or all of the signals in the upper left quadrant to move them into the upper right.

You might also, at the same time, consider eliminating or reducing some things in that lower right quadrant, where there are elements that aren’t very highly valued. Eliminating or reducing those elements may help you offset the cost of other changes you make.

A second approach, particularly if a product is selling reasonably well, but you want to reposition it on your Value Ramp, is to improve the delivery of the upper left quadrant and then raise prices.

In general, the Product Value Profile is a good tool for evaluating your offerings and making decisions that enable you to change them relative to price.

Many organizations resist raising prices, particularly in tough economic times, but a small price increase can have a significant impact. It’s been established that an increase in price is one of the most effective ways to increase profit. Even if you’re a nonprofit, this margin can be channeled into delivering on your mission.

A study by the consulting firm McKinsey & Co. back in the 1990s showed that a 1-percent increase in price translates into an 11-percent increase in profits.

On the other hand, increasing your volume of sales—getting more registrations or enrollments by that same amount—by that same 1-percent, results in a 3.3-percent increase. Cutting variable costs by 1 percent resulted in a 7.8-percent increase, and cutting fixed costs resulted in a 2.3-percent increase.

The bottom line is that raising prices, even by just a little bit, is usually the most effective way for an organization to increase profits on their learning offerings.

And, if you’re using value-based pricing, you’re raising prices when you provide something of high value.

See our related episode “Value-Based Pricing with Dr. Michael Tatonetti.”

The Product Value Profile offers insights into how your products stand out in the market and provides the basis for pricing that is different from the rest of the competitive pack.

Jeff Cobb

[24:21] – Wrap-up

To make sure you don’t miss new episodes, we encourage you to subscribe via RSS, Apple Podcasts, Spotify, Stitcher Radio, iHeartRadio, PodBean, or any podcatcher service you may use (e.g., Overcast). Subscription numbers give us some data on the impact of the podcast.

We’d also be grateful if you would take a minute to rate us on Apple Podcasts at https://www.leadinglearning.com/apple. We personally appreciate reviews and ratings, and they help us show up when people search for content on leading a learning business.

Finally, consider following us and sharing the good word about Leading Learning. You can find us on Twitter, Facebook, and LinkedIn.

Episodes on Related Topics:

Value-Based Pricing with Dr. Michael Tatonetti

Value-Based Pricing with Dr. Michael Tatonetti

Leave a Reply