We recently told you about the major areas that all learning businesses should be thinking about as they consider how best to grow and improve their offerings – what we coined the 4 “Cs” of the current learning landscape. And that included concision, context, competency, and community.

But we quickly realized there was another area of equal importance that wasn’t originally included so we are unveiling a fifth “C” to add to this important list of trends impacting the learning business landscape – competition.

In this episode of the Leading Learning podcast, Celisa and Jeff discuss ways to help you get a handle on the competition in your market using Michael Porter’s Five Forces model as a framework for discussion.

To tune in, just click below. To make sure you catch all of the future episodes, be sure to subscribe by RSS or on iTunes. And, if you like the podcast, be sure to give it a tweet!

Listen to the Show

Read the Show Notes

[00:18] – A preview of what will be covered in this podcast where Celisa and Jeff discuss the fifth “C” of the learning business landscape: competition.

[00:34] – Thank you to NextThought, the sponsor of the Leading Learning podcast for the third quarter of 2018. NextThought is your partner in learning management system technology, creating engaging experiences, increasing learning potential, participant satisfaction, and member retention. Empowering learning businesses like yours with the perfect combination of art, science, and technology of online learning, Next Thought helps you achieve your education goals. They go above and beyond the standard learning management system by offering comprehensive solutions, including a modern, elegant technology platform, an evidence-based learning design methodology, and professional video production services. Visit https://www.NextThought.com to learn more.

[01:46] – Highlighted Resource of the Week– Our previous podcast episode, The 4 Cs of the Learning Landscape.

The Fifth C

[02:09] – The fifth “C” of the learning business landscape: competition.

It’s a significant issue for most learning businesses, and there are a lot of ways to come at it. One that we have already discussed in an earlier episode is to try to make the competition irrelevant by pursuing a blue ocean strategy—see our previous podcast episode, Blue Ocean Strategy for Your Learning Business.

We certainly encourage you to review it or listen to it for the first time if you haven’t listened to it already, but for this episode we thought we would turn to a somewhat different take on strategy and competition.

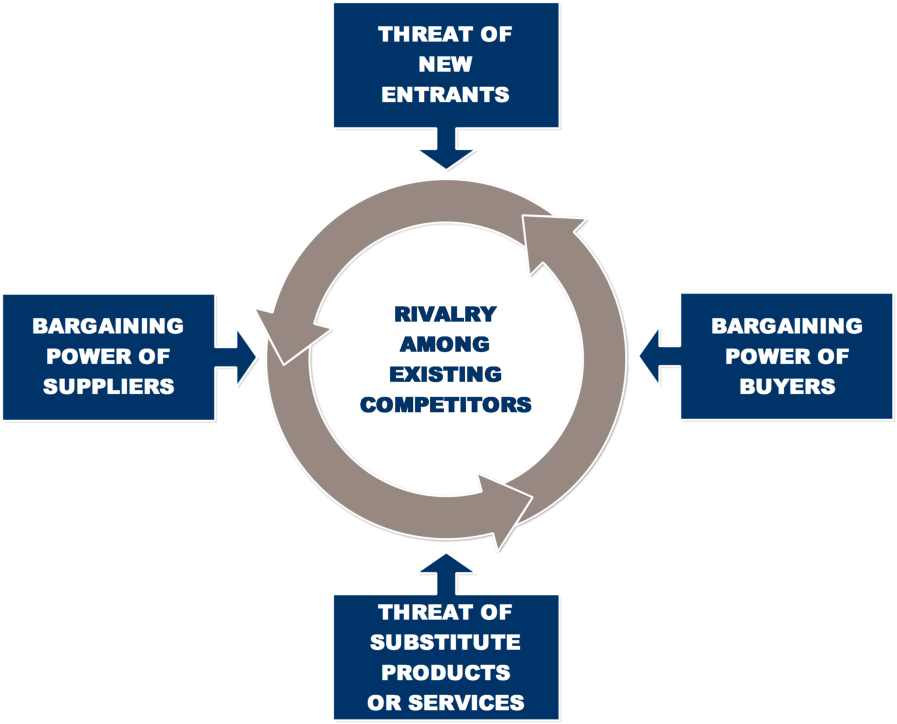

Namely, the “five forces” model developed by Harvard Business School professor Michael Porter.

This model was first published in 1979 and has had significant staying power. The basic idea is that every industry and field is different, but the underlying drivers of profitably are the same in every one.

Profitability means net revenue so even if you’re not a for-profit organization, profitability still matters and the underlying drivers are going to be the same.

The Five Forces that Porter describes determine the competitive structure of an industry, and its profitability.

Industry structure, together with a company’s relative position within the industry, are basically the two basic drivers of company profitability. So analyzing the Five Forces can help companies anticipate shifts in competition, shape how industry structure evolves, and find better strategic positions within the industry.

From our standpoint, it’s a fantastic tool for diagnosis.

Threat of New Entrants

[05:10] – We’ll start with the threat of new entrants. One way to come at this one is to imagine if you wanted to, could you go out and start your own education business tomorrow? How would you go about it? And if you were going to go out on your own and start a learning business today, what would you do?

The point is that it’s just not that hard to enter this market, the barriers to entry are low for any person or organization that has access to a reasonable level of expertise in a particular field or topic—a little Articulate, some GoToWebinar, and a free or low-cost learning platform.

That’s taking the online route, of course, but even organizing, managing, and promoting face-to-face education is much easier than it used to be.

In general, it is easier than ever for new entrants to get into the education business, thanks in large part to technology changes. So the threat of new entrants is pretty high.

Most learning businesses we’ve worked with are seeing this shift—if there is any significant demand for education in the market you serve, then you’ve almost certainly seen new providers enter the market over the past several years.

If you represent an association or other nonprofit, you may be seeing commercial providers enter; if you are a commercial provider, you maybe seeing new companies pop up. In general, there are more producers of courses, seminars, events, Webinars, e-learning—you name itin just about every education market.

But it’s not just about production – an increasing number of companies are becoming what we call “market makers” – providing not just tools for creating and piblishing courses, but also providing a ready made market places and all of the necessary tools for selling – including a doorway into corporate/institutional training departments.

This group includes companies like Udemy, for example, which has become a sort of Amazon.com of online courses – and has a clear focus on serving not just individual learners, but also companies.

All of this makes for a very competitive market environment in which learning business really have to be nimble and really have to define and articulate their distinctive value to prospective learners.

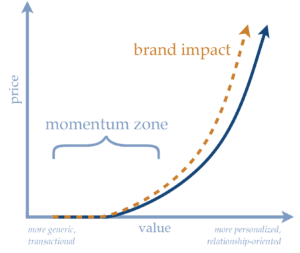

We’ve found that a key protection many existing learning businesses have against that threat is brand and the loyalty it can inspire. If you are an established, “go-to” provider in your market, you definitely want to do everything you can to sustain and strengthen your brand – through value and also through great customer experience.

To help with those efforts, check out our previous podcast episode regarding Value Ramp as a way to identify and manage value.

Also check out the episode we did with customer experience expert Jay Baer.

Bargaining Power of Suppliers

[08:27] – Who are the suppliers you deal with? One of the most common supplier groups that learning businesses deal with is subject matter experts, SMEs.

This is one of the biggest shifts we’re seeing and one that’s not being fully accounted for by most organizations.

Now that technology has made it so easy for a SME to offer a Webinar on her own and connect directly with your members and customers via social media, what’s to stop the SME from entering into direct competition with you and becoming that threat of a new entrant?

Experts—the very experts that many of you rely on for your seminar, conference, and e-learning content—now have a wealth of support for taking their content online and monetizing it.

There are any number of companies now providing easy-to-use platforms with lots of educational support for helping instructors make the leap to online successfully. We’ve already mentioned Udemy, but that’s just one of many examples –see our blog post, Learning from Big Learning: 14 Lessons where we highlight several more.

We know a range of instructors who are making serious money with their online offerings and are using these to fuel their offline consulting, speaking, and training businesses.

The critical shift here is that learning businesses need to forge different relationships with their subject matter experts. They need to be asking and discussing with the experts what value they can add to the experts’ intellectual property, and what new channels they can open up or opportunities they can present that experts may not necessarily be able to access and leverage on their own.

For learning businesses that rely on volunteers or low-paid presenters, we may also see a shift toward needing to pay to get the best, or at least the highest level of combined expertise and teaching talent.

Learning businesses can position themselves as cultivators of teaching talent in the adult learning market. This is a real opportunity for trade and professional associations, who can position this kind of support for their presenters and facilitators as a member or volunteer benefit, particularly for younger members, who they can help develop effective, impactful teaching skills, which are really valuable in today’s employment market.

Associations, in particular can do this, but this is an opportunity open potentially to any learning business.

Bargaining Power of Buyers

[11:33] – Next let’s talk about the bargaining power of buyers—meaning your members, your customers, however you categorize your prospective learners.

These people have more options than ever before, which gives them a lot of power to demand what they want from you—or, at least the right to refuse to buy anything that doesn’t really hit the mark.

We’d encourage you, for example, to think about your own “personal learning inventory”. Basically, the array of resources that you go to day in and day out for your learning needs.

For example, participating in communities, listening to podcasts, watching videos, or using apps to help learn languages. The list goes on and on.

We challenge you to consider a similar exercise for yourself. All of this changes our expectations—often unconsciously—of what learning should be and, of course, what we are willing to pay for. Arguably, it really raises the bar for learning providers. And, as many learning business have experienced, because so many resources are now free, there is a lot of downward pressure on pricing.

There’s also an interesting question about how learners effectively navigate all of this, what our role as learning businesses really is, and how we need to approach this whole landscape of learning and technology.

We’ve talked before, for example, about the critical role of curation (that’s something we covered in the 4 Cs episode as well as in our episode, Capitalizing on Curation).

This is another place where some of those new entrants are potential disruptors. A company like Degreed, for example, is really focusing in on giving the learner power, and then figuring out how to leverage that relationship with the learner in the context of serving corporate education needs—see our episode with Kelly Palmer, CLO of Degreed.

Another important factor in addressing this issue of learner power is being really clear about determining the learner’s you are best positioned to serve and to whom you can really provide significant, distinctive value.

Segmentation and identifying the best buyers are more important than ever.

If, for example, you are serving the accounting profession, maybe your real value is in focusing on accountants who really identify as entrepreneurs.

This is what Jason Blumer has done with his Thriveal Academy, for example. Check out the Learning Revolution podcast episode that Jeff did with Jason.

Threat of Substitute Products or Services

[14:30] – The threat of substitute products or services is basically all about how easy it is for someone else to create and offer the same kinds of products or services that meet the same basic need as your educational offerings.

We’ve already been touching on this issue to a significant extent as we have talked about the other forces, but there is an interesting additional question to be raised here. Namely, what actually is the need your educational offerings fill?

For example, if they are purely about access to information, then there may be any number of substitutes unless you can legitimately position yourself as having access to the most timely information, or information that simply can’t be gotten through other sources.

Many learning businesses, we find, convince themselves that they are in this position, but really they aren’t – information just spreads too fast in today’s world, so you need to be really vigilant if this is the position you want to maintain.

Another option would be around access to credit or a specific type of validation –meaning, for example a particular certification or credential. Maybe that is the core need your education is tied to.

That tends to be a harder positioning to establish—particularly on an exclusive basis—but even if you are at least one key source of education related to a particular credential, it can become harder to substitute for you.

A learner can’t, for example, simply opt to participate in a free course on a topic if the course doesn’t provide credit the she needs. On the other hand, if you are the sole source of the education and the credential, then there really is no substitute.

That’s tough to do because the demand needs to be there and the market perception of your brand generally needs to be high. We can’t name names on this one, but we have seen an increasing number of learning businesses move to create or reinforce this kind of positioning.

Related to the point is the whole question of prestige. In many cases, what the need that education fills is only partly about knowledge or credit. The prestige associated with having participated in and completed the learning experience may be absolutely essential to what the learner is seeking.

Again, in this case, there are few if any substitutes. Many people are willing to pay to attend TED, for example, as much so that they can say they attended TED as for whatever learning happens there.

The bottom line here is, how can you strengthen the positioning of your learning business so that there are few or no substitutes for what you offer.

Rivalry Among Existing Competitors

[18:32] – In many education markets competition has gotten much more intense among the providers who are already in the market, and there is a good chance that many of you are feeling this shift.

From Porter’s perspective, there are a range factors that contribute to heightened rivalry among existing competitors, but we’ll just highlight a few that we think are particularly relevant right now in the learning business:

- Competitors are numerous.

- The offerings are often not really differentiated in many markets. Topics and presenters change, of course, but in the accounting market, for example, a CPE course is a CPE course, at least in the eyes of the prospective learner. The same is often true across medicine, law, and any number of other fields.

- Brand loyalty is insignificant. Many learning businesses simply do not have a strong brand for either their business or their offerings.

- Buyer switching costs are low. Learners have more options than ever and it is usually not hard for them to jump from provider to provider.

- There is excess production capacity. Barriers to entry are low and that is causing a glut in the market and leading to the bloody “red ocean” conditions that we have discussed in our episode on Blue Ocean Strategy.

Of course, the high-level response to all of this is that learning businesses are simply going to have to be much more strategic, whether than means striving to differentiate and compete effectively in a crowded market or it means trying to make that leap to a blue ocean where you make the competition irrelevant.

[21:28] – Wrap Up

If you are getting value from the Leading Learning podcast, be sure to subscribe by RSS or on iTunes. We’d also appreciate if you give us a rating on iTunes by going to https://www.leadinglearning.com/itunes.

And we’d be grateful if you would take a minute to visit our sponsor for this quarter, NextThought. We put a lot of time and energy in to the Leading Learning Podcast, and one of the key reasons we’re able to do that is because of the support of sponsors like NextThought so please visit NextThought.com.

Also, consider telling others about the podcast. Go to https://www.leadinglearning.com/share to share information about the podcast via Twitter, or send out a message on another channel of your choosing with a link to https://www.leadinglearning.com/podcast.

[23:23] – Sign off

See Also:

Getting Conscious About Bias with Howard Ross and Shilpa Alimchandani

Getting Conscious About Bias with Howard Ross and Shilpa Alimchandani

Leave a Reply