Understanding what potential learning customers want, not just what they need, can be a difficult task.

But if you’re tuned into what types of data to gather as well as the right questions to ask surrounding this, you should be able to begin to see the difference—something that has the potential to bring tremendous value to your learning business.

In this episode of the Leading Learning podcast, we discuss how to get at what potential learning customers actually want – versus what they need – by exploring four key areas of gathering and assessing data including: understanding your demand dynamics, assessing behavior (not preferences), identifying key value factors, and gauging commitment and conversion (not interest).

To tune in, just click below. To make sure you catch all of the future episodes, be sure to subscribe by RSS or on iTunes. And, if you like the podcast, be sure to give it a tweet!

Listen to the Show

Read the Show Notes

[00:18] – A preview of what will be covered in this podcast where we discuss how to determine what your potential learning customers want – not just what they need – by exploring four key areas of gathering and assessing data.

Note this will also be the topic of a Content Pod™ at Learning • Technology • Design™ (LTD).

As we did with the strategy session we planned to lead at LTD (see our episode, 3 Core Elements of Learning Business Strategy), we wanted to use this episode to talk through some of the ideas they plan to share in that session.

[00:50] – Thank you to Blue Sky eLearn, sponsor of the Leading Learning podcast for the first quarter of 2018. Blue Sky is the maker of the Path learning management system, an award-winning, cloud-based learning solution that empowers your organization to maximize its message. Blue Sky also provides a range of virtual event and instructional services to help you maximize your content and create deeper engagement with your audience. To find out more about Blue Sky eLearn and everything it offers, visit https://www.blueskyelearn.com.

Highlighted Resource of the Week

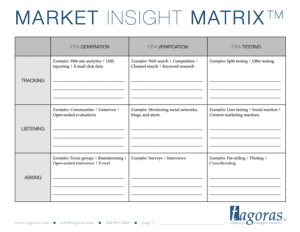

[01:21] – Market Insight Matrix – a free Tagoras tool that lays out a framework for continually monitoring and assessing your market over time. It’s a great complement to the discussion in this episode about identifying the “wants” as opposed to just the needs in your market.

4 Key Areas of Gathering and Assessing Data

[01:50] – We are going to focus in on what we see as four key areas of gathering and assessing data as well as cover some of the key questions we’ve found it valuable to ask.

These are areas that tend to apply well during those times when a learning business has allocated resources specifically to conduct some sort of market assessment, usually referred to as a “needs assessment.”

We strongly advocate ongoing monitoring and assessment as opposed to one shot initiatives – which is why the Market Insight Matrix is the Highlighted Resource for this episode. But we also know the reality is that many organizations only intermittently dedicate resources to assessment, so we want to offer some tips that will be helpful on those occasions.

1. Understand Your Demand Dynamics

[03:17] – Often your greatest evidence for what your customers will want in the future is what they have either been buying already or what they have been looking for – and, to the extent you can determine, why?

Data to consider:

- Product-by-product purchasing trends over the course of the past quarter, year, or more – the period of time really depends on the shelf life your offerings tend to have.

- Session attendance at multi-session events.

- Search queries that have brought people to your Web site (not just your catalog)—note one of the main places you can go for this is the Google search console.

- Survey questions about specific competitors or competitor offerings.

- Discussion forums/communities.

Other important considerations for understanding the demand dynamic:

- Who really makes the buying decisions – and/or heavily influences it? In many cases, for example, you may actually have offerings that learner’s want, but are not purchasing at expected levels. Often this is because the learner’s aren’t really making the buying decisions – and you are not really meeting the wants of those who are.

2. Assess behavior, not preference

[08:37] – Again and again there are surveys that ask learners, for example, what learning format they prefer.

These are notoriously unreliable.

In many cases, learners really don’t have enough experience to say; and even if they do, preferences are generally a poor predictor of behavior.

Again, it’s useful to look at some of the data previously discussed to see what learners are actually doing and how they are behaving.

Similarly, when you are doing surveys and interviews, focus much more on behavior than preferences.

3. Identify key value factors

[12:22] – It’s also very important to know what kinds of factors prospective customers weigh when making purchase decisions. Asking about this in the context of a survey or interview gets close to asking about preferences, but there are ways to ask about it that can then be tested over time.

So, for example, we will typically include a question that runs along the lines of:

Imagine that you are considering whether to register for a professional development program of any format (e.g., whether classroom or online) that seems to meet your needs. How important would each of the following factors be in assessing its potential value?

The potential responses would include some obvious items like, “The content is presented by a reputable subject matter expert with significant, relevant experience,” but also some items that we find learning businesses are less likely to ask about, like “The program has been shown to produce demonstrable improvement in knowledge or performance for those who take part.”

What the outputs from this line of questioning give you are some criteria for assessing your current marketing efforts.

To what extent do your marketing materials emphasize or even reference the value factors that you ask learner’s about?

We’ve found time and again that these factors are often poorly represented, if not missing in action entirely, on sales pages, brochures, and other marketing materials.

Once you have this kind of input, you can make changes and then measure the impact.

Often, organizations do have what learners want but they just aren’t framing it very well in how they’re communicating it.

And sometimes you may need to prove to the learner that you have what they want.

For example, when it comes to learners wanting a reputable subject matter expert (SME), oftentimes their expertise and other important information isn’t emphasized at all in the catalog.

When it comes to showing demonstrable improvement in knowledge or performance, many organizations often don’t have proof of this and they aren’t doing anything to get proof.

There are simple steps to take to get some, even if it’s in the form of social proof or testimonials, but it’s often almost always missing.

When it comes to SMEs, when organizations do make the information available, too often it’s the same bio that gets used over and over versus really highlighting why this person is talking about this subject.

But copywriting matters as well as being able to position things properly to the audience.

Also, when it comes to measuring impact, if you don’t have that data but you know your learners want it, it gives you not only the motivation to gather it, but also some ammunition internally to get it.

4. Gauge commitment and conversion, not interest

[17:24] – There are a lot of times that learning businesses will ask prospective customers about whether they are interested in a particular offering. And a lot of times what happens is that people say they are interested, but then very few people sign up when the course – or whatever –actually offered.

Below are a few strategies to potentially combat this:

- Out of the gate, gauge whether or not the prospective learners are aware of current offerings—and if so, have they participated? What’s the gap between awareness and participation? If a low number are aware, but they convert at a high rate, then you probably have an awareness problem. If a high number are aware, but are converting at a low rate, then you have a product or pricing problem.

- For specific offerings, ask prospective learners how likely are they to do it. Get as close to actual, descriptive titles that you could really see offering – not just asking about generic areas. Or, if you start with generic, get some details on what they need to cover and then go back out with some more detailed titles.

- Finally, test. Run pilots, using low cost approaches like Webinars. Publish downloadables in a target topic area that require e-mail sign up—even if you already have their email. Note all of this is keeping with the idea of the minimum viable product.

[24:55] – A summary of all the key ideas discussed.

[27:03] – Wrap Up

If you are getting value from the Leading Learning podcast, be sure to subscribe by RSS or on iTunes. We’d also appreciate if you give us a rating on iTunes by going to https://www.leadinglearning.com/itunes.

We’d also be grateful if you would take a minute to visit our sponsor for this quarter, Blue Sky eLearn. In addition to finding out about their services, you will also find a variety of great resources that they offer for free.

Also, consider telling others about the podcast. Go to https://www.leadinglearning.com/share to share information about the podcast via Twitter, or send out a message on another channel of your choosing with a link to https://www.leadinglearning.com/podcast.

[28:53] – Sign off

See Also:

Designing Engaging Learning with Tracy King and Aaron Wolowiec

Designing Engaging Learning with Tracy King and Aaron Wolowiec

Leave a Reply